Page 4

PAGE 4 | How Debt Funds Use Warehouse and Other Credit Lines

Ability to access a very secure (low attachment point) private credit investments with attractive yield

As described earlier, the NR-LOC features a very low level of risk because the amount invested will typically be around 50% of the value of the real estate that secures the underlying loans. At the same time, the yield can be much higher than many real estate and other loans currently being made by banks. The structure is designed so that even if the non-bank lender runs into operational problems, another non-bank lender is standing by to take over and service the portfolio of underlying loans so that the investor can be paid off. As to the credit quality of the borrowers on the underlying loans, the investor can make their underwriting criteria known and non-bank lenders can create portfolios specifically to meet those criteria.

Ability to pick and choose counterparties and loans

Non-bank lenders come in all shapes and sizes. The investor can choose to work with only those non-bank lenders whose platforms they consider best-in-class, and whose loans fit the investor’s preferences. For example, a regional bank active in California might choose to invest only into NR-LOCs where the counterparty is a non-bank lender that has deep experience in that region, and has mostly repeat borrowers. Furthermore, the specific collateral portfolio for an NR-LOC can be customized based on the preference of the investor.

Potential to achieve scale, with growth of private credit markets

According to a recent white paper by Blackstone Group, private credit has grown to a $1.2 trillion market.2 McKinsey’s study shows that in North America, capital raising for all private investments (including real estate) has grown 21% in the latest year.3 By all accounts, private credit is a vast and growing area of finance and can offer attractive and non-correlated characteristics relative to other investments. In short, this can become a distinct new asset class for those investors focused on income and capital preservation, who do not really need daily liquidity. Investing in real estate NR-LOCs might open the door to similar investments in the future secured by non-real estate loans, making the market even larger.

Minimal interest rate risk

Most fixed income investments include many investments with long maturities. This means that if interest rates rise, the market value of the investment falls–a fact that bond investors know very well as of the time of this white paper’s publication (mid 2022), with many bond portfolios having lost about 10% of their value in the preceding six months. In contrast, the proposed NR-LOC is scheduled to be mostly paid off within 12-18 months, depending on the underlying loan types. As such, an investor in this structure can have their original capital back, plus interest, in a relatively short amount of time, vs. having an investment lose value if interest rates rise, and facing the choice of holding to maturity which may be many years for most fixed income investments, or selling at a loss before maturity.

Potential to have investments rated by a rating agency, if necessary

It may be possible to have a rating agency underwrite and rate a NR-LOC or a series of such LOCs. To engage one of the major bond rating agencies, the cost would likely be too high, unless the size of the LOC is very large, similar to the size threshold required for a securitization, which is approximately $200 million. However, there is a separate set of rating agencies that provide ratings to insurance companies. For example, Egan-Jones provides ratings for private placements and in the past was open to rating the author’s company-run debt funds. Having a rating may make it easier for certain investors to provide capital for the proposed program.

2 Source: https://www.bcred.com/private-credits-rapid-growth_a-secular-trend/

3 Source: https://docs.google.com/document/d/1_ptewvOknepCIPy07xiXJeaEvde6N_cA3Zd282zuYn0/edit#

Advantages for the non-bank lender

Ability to complement other forms of structural leverage

Non-bank lenders need diverse sources of capital in order to navigate both growth and market volatility. The larger the lender becomes, the more critical it is to have different types of lines of credit from multiple types of investors. By maintaining diversity, the non-bank lender can continue to provide certainty of execution to their borrowers, which is one of their main value propositions to real estate investors and developers. The proposed NR-LOC structure provides another tool for growing non-bank lenders, and adds value simply by being different and potentially coming from different sources than the other forms of structural leverage.

Ability to reduce cost of capital

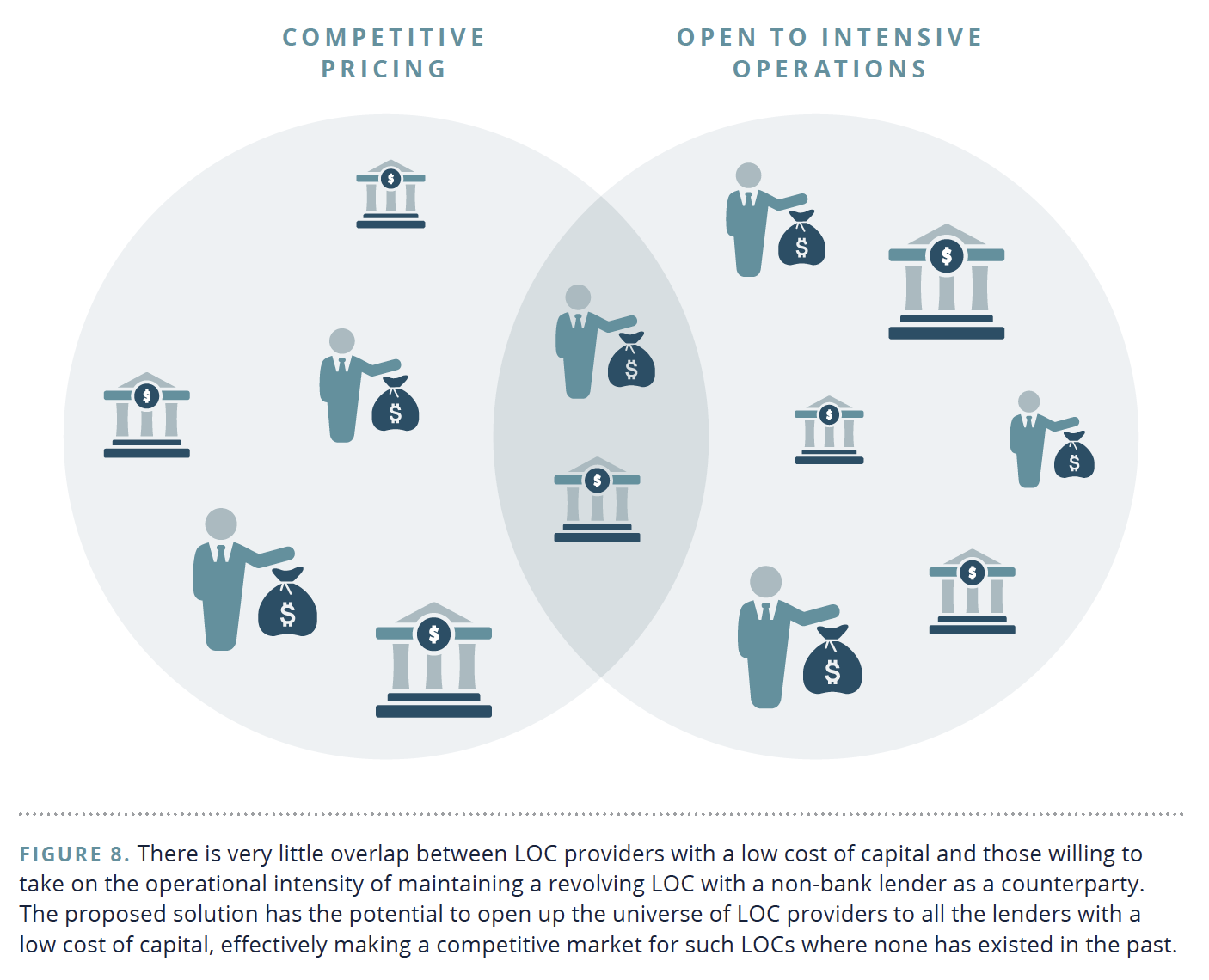

Currently, there is not much competition among providers of warehouse lines of credit. For that reason, pricing has remained fairly high relative to the risk of losing principal on these LOCs. Among those banks and other investors who like the risk and return characteristics of proving these LOCs, the great majority are deterred by the operational intensity of operating such facilities. On the other hand, among those providers of credit who are open to taking on the intensive operations required, very few have a low enough cost of capital to provide truly competitive rates. The diagram below depicts this relationship. By reducing or eliminating the need to take on the operations of such a line, the proposed solution would create competition, which should drive down borrowing costs for users of structural leverage.

Very scalable source of capital

By widening the universe of potential investors in these LOCs, the proposed approach not only reduces cost but should greatly increase the depth of the market. Any bank, insurance company or other fixed income investor able to make illiquid investments becomes a potential provider of structural leverage to non-bank lenders. This will ensure that non-bank lenders are never limited based on their access to super-senior financing.

No arbitrary mark-to-market feature

As discussed previously, repo lines are unpredictable for non-bank lenders. When the stock and bond markets become very volatile, the repo line provider may inform the non-bank lender that the underlying loans are no longer sufficient collateral for the repo LOC, even if the underlying loans are performing very well. In that case, the non-bank lender can be forced to post additional collateral in a matter of days or even overnight, in order to avoid having the underlying loans sold by the repo lender, potentially at catastrophic losses. In contrast, the NR-LOC has no such mark-to-market feature. The underlying loans would only be marked down from par if the underlying properties had declined significantly in value, based on third party appraisals, to the point that the loan became impaired. This is a much more predictable process for the non-bank lender and therefore greatly superior to a Wall Street-style repo line, all other things being equal.

No risk of paying hefty non-use fees

With securitizations and some existing warehouse lines of credit, the non-bank lender must pay interest on most or all of the maximum loan amount, whether or not that money is invested in loans. In other words, the non-bank lender faces a real risk of having very large interest payments due to the bank or other warehouse lender, even if underlying loans have paid off and the proceeds have not yet been invested in new loans. With the NR-LOC structure, the non-bank lender will never pay interest on capital unless that capital is invested in loans. The NR-LOC gets paid down automatically whenever an underlying loan pays off, so the line of credit is “right-sized” automatically at all times.

Potential to build in flexibility, such as sub-limits for underperforming loans

With bank warehouse lines of credit, non-bank lenders often face loan terms that leave little room to maneuver when markets evolve. For example, most warehouse lines require that any non-performing or sub-performing underlying loans be removed from the collateral pool. The NR-LOC structure may allow for customized terms, such as allowing for a small portion of the loans in the portfolio to be sub-performing, without their needing to be taken out of the collateral pool immediately. In general, non-bank lenders who build a strong relationship with investors or whose loan portfolios are unusually attractive, may be able to negotiate customized terms that meet their needs, which may not be available through bank warehouse lines of credit or securitizations.

Issues to consider

Private placement investments are not liquid

For some investors, any lower-yielding income investment must be liquid and tradable on a day’s notice or less. These investors may view any illiquid investment as needing to generate high single digit returns to justify their lack of liquidity. For these investors, the proposed NR-LOC investment structure would not be attractive, because while it is projected to generate payoffs every month, with most of the investment liquid within a year, there is not yet any secondary market for such investments. An investor must be comfortable holding this type of investment on its balance sheet until it pays off naturally.

Structure is somewhat novel, which entails some uncertainties

The NR-LOC structure borrows heavily from bank warehouse LOCs and securitization structures that have been tested heavily through all kinds of markets. However, the specific structure proposed here is somewhat novel and so there may not be concrete answers as to how certain scenarios are treated when the financial system experiences stress. For example, the details of exactly how long it takes for the standby non-bank lending platform to step in to service the underlying loans and pay off the NR-LOC are hard to predict until the structure is tested in practice.

Conclusion

Since the GFC, non-bank lenders have become very important to real estate investors and developers. As these firms grow, many of them need additional structural leverage. While bank warehouse lines of credit and securitizations provide many benefits, there is a need for more diverse and flexible sources of capital to allow the industry to keep growing. The proposed solution is designed to allow a wide range of safety-oriented investors to participate in providing credit to this market. For those investors seeking capital preservation and income, without taking on operational responsibilities, the proposed system of non-revolving lines of credit could supplement existing solutions so that all market participants become better off. This would benefit the wider economy by ensuring that diverse financing solutions are available for real estate investment and development.

You may also like

WHITEPAPER | Understanding Private Debt Funds - A Guide for Fiduciaries and Individual Investors

This is Arixa's signature white paper about the type of investing we and our peer companies do. It uses real estate loans as an example but is designed to educate investors about all types of funds investing in performing loans, which in our view will be an increasingly important asset class in the years to come. Available online and as a PDF download.